Expat Global Art with an yield of nearly +27% for its first year

29.06.2020

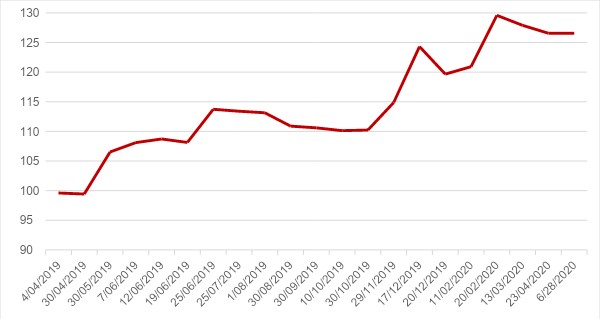

The net asset value per share of Expat Global Art has risen by +26.6% since its creation in March 2019.

Expat Global Art is the only investment fund in Bulgaria which allows a wide group of investors to profit from artworks as a separate investment class. Art is considered to be an attractive investment, that is weakly correlated with other assets such as shares, bonds, real estate etc. The fund’s portfolio comprises of artworks of artistic, numismatic, and philatelic character, allowing shareholders to profit from the rising prices of these artworks in the medium and long-run. As of now, the fund has around 400 works, which can be viewed on www.expatglobalart.com.

Expat Global Art is organised as a joint-stock company with two types of asset classes. The fund is an open type and can constantly issue and repurchase its own shares at the current price. Essentially, it is the first institutional investor on the Bulgarian art market.

The fund adds value to its investors in multiple ways:

1. Access to artwork as a separate asset class, usually difficult to access for the mass investor and for institutional investors.

It would be difficult for a classic investor to directly use artworks in their investment strategy to diversify risk or to achieve higher returns. The lack of expertise and knowledge about the market, technical peculiarities of purchases and sales of art, risks linked to counterfeiting and storage, as well as a lack of competency in the market trends, make artwork as an investment class difficult to access for non-professionals. Institutional portfolio investors, by definition, normally cannot hold tangible (physical) assets (assets that are not financial instruments) in their portfolios and cannot directly participate in this market. Expat Global Art would be suitable for portfolios of such investors that are seeking risk diversification in asset classes with low correlation to capital markets. The features of art as an investment class make it suitable for longer-term investment strategies.

2. Professional management, value and authenticity guarantee, risk management and diversification

The professional management of the fund, comprising of the cooperation with professional consultants, valuers, insurers, and custody institutions for its assets and documents, is a guarantee of the value and authenticity of the works of the portfolio.

The fund’s strategy is aimed towards the creation of a balanced portfolio of works with the focus on modern artists, whose artwork can soon be valued highly, and also well-known artists, who can be re-discovered by the market. The fund is constantly looking for good deals, including with the artists themselves, who, by being in the fund’s portfolio, are able to achieve validation for their prices and greater opportunities, allowing them to showcase their work in front of a larger and more specialized audience. The fund does not have a strategy of creating a permanent collection, but is looking for worthy works with good potential for reselling on the market, so that it can guarantee profits for the shareholders from the rise in prices of the artworks in the medium and long-run.

Part of the fund’s strategy is also to seek for profitable art purchases from countries where prices are low and investment interest in the asset class is lacking, and sell them in the markets where prices are high and investment interest in the asset class is more widespread.

3. Active management of the portfolio in order to achieve an increase in the fund’s investments value

The Fund, as a larger, professionally managed and publicly known owner of artworks, will be able to achieve significantly better price conditions upon purchase and sale of artworks than individual players usually can in the market, even those, who consider themselves professionals. Until now, the fund has sold 22 pieces of artwork from its portfolio, achieving an average profit of over 50% by the purchase prices.

As an institutional investor, the fund has easier access to different artists from different countries, as opposed to an individual investor. This leads to better opportunities and conditions for purchases and sales of artworks. Moreover, the higher public profile of the fund makes it a natural potential partner for other small or large market participants who would look for it as a potential buyer or seller of works.

Expat Global Art already has experience in acquiring whole collections. Part of the fund’s strategy is finding promising but no so famous artists, whose artworks the fund can buy at bargained prices, and, after popularizing, sell with significant profits for its shareholders.

For more information about Expat Global Art, go to www.expatglobalart.com.

Net asset value per share dynamics*

*The fund’s NAV is calculated for every significant event in its portfolio, but no less frequently than once every three months. The graph shows the dynamics in the price of class B shares. Class B shares are specially created to give investors the opportunity to invest in a portfolio of artworks through the fund and to benefit from this. Class B shares carry all the economic benefits of the fund’s activities. Class A shares are designed to control the fund’s activities. They do not carry economic benefits from the fund's operatrions for their owners.

-------------------------------------------------

Expat Global Art is organised as a joint-stock company, registered at the Trade Register on the 5th of March 2019 with UIC number 205550338 with asset classes A and B. The asset portfolio of Expat Global Art is comprised of artwork with artistic, numismatic, and philatelic character.

Every class A share is given the right of a single vote in the general meetings of shareholders, with a limitation (without the right) of the liquidation share, and with a reduced portion (without the right) in the distribution of dividends. Every class B share is not given the right of voting with a redemption preference, under the conditions, defined in the Fund’s Articles of Incorporation, with the privilege in the liquidation share defined in the Fund’s Article of Association; with a dividends distribution privilege, determined in the Fund’s Article of Association. Class A shares are vinculated. Class B shares are freely transferable. Class B shares are specially created to give investors the opportunity to invest in a portfolio of artwork through the fund, and to profit via it. Class B shares hold all the economic benefits of the fund’s activities. Class A shares are created with the aim of controlling the fund’s activity. They do not carry economic benefits to their investors from the fund’s activities.

This content is for information purposes only, and no part of it can be used as an offer or invitation for a deal to buy or sell financial instruments and/or professional advice, in relation to an investment decision. All necessary action has been taken to guarantee the preciseness of the content, but under no conditions are Expat Capital, Expat Asset Management, and Expat Global Art responsible for this content and do not promise the receivers or third parties anything in terms of the preciseness, the completeness and/or correctness of the information included in this document. Expat Global Art allows all parties who are interested in getting to know the Bulgarian Statute, accounting reports and other information, to visit the site www.expat.bg and the company’s offices (Bulgaria, Sofia, 96A Georgi S. Rakovski Str.) on workdays from 9:00 a.m. to 6:00 p.m.

The investors should bear in mind that the forecasts are not an indicator for future returns. Previous results do not guarantee future results, with the value of the investments possibly increasing or decreasing, leading to significant losses. Profits are not guaranteed and there exists a risk of the inability to recover the invested amount. Investments in shares of a mutual fund or through an individual investment account are not guaranteed by the state guarantee fund or by another type of guarantee.