Bulgaria and Croatia Have Joined ERM-II and the Banking Union in Preparation for the Eurozone

15.07.2020

Last Friday night, on 10 July 2020, Bulgaria (EU member since 2007) and Croatia (2013) were invited to join the Exchange Rate Mechanism (ERM-II) and the Banking Union. This suggests that the two countries should join the Eurozone in several years. As of today, our expectation is 1 January 2024.

There are several implications for the two countries, all of them positive for the stock markets:

- The stability and the credibility of the banking sectors should increase. On the one hand, the European Central Bank (ECB) will be supervising the largest banks. On the other hand, the ECB will be able to provide liquidity to the banks, if needed.

- The budget discipline should be stronger. 2020 is a special year due to COVID-19. Going forward, however, Bulgaria and Croatia are expected to continue being very conservative with budget spending in order to stay in shape for the Eurozone.

- Countries joining ERM-II and the Eurozone usually experience increased FDI, trade, and tourism. Salaries are expected to continue their upward trend.

| DOWNLOAD NEWSLETTER |

Bulgaria has low debt, and a budget surplus in H1 2020

Croatia has a 50% higher nominal GDP per capita than Bulgaria, and 10% higher on a PPP (Purchasing Power Parity) basis. However, Bulgaria has better budget and debt indicators for 2020.

Table 1. Selected Budget Indicators

| Croatia | Bulgaria | |

| Debt/GDP, 2019 | 74.2% | 19.9% |

| Debt/GDP, 2020E | 86.7% | 22.0% |

| Budget surplus (+)/deficit (-), H1 2020 | N/A | +1.4% of the annual GDP |

| Budget surplus (+)/deficit (-), 2020E | -7% to -8% | -1% (Expat’s forecast) |

Source: Trading Economics, IMF, World Bank, Eurostat

Despite the coronavirus, Bulgaria managed to achieve a large budget surplus in H1 2020 (almost +3% of the half-year GDP) due to higher VAT revenues and thrifty budget spending. It is difficult to predict the development of the pandemic in H2 and hence the depth of the recession. For the time being, we envision a small deficit for year-end.A balanced budget is also possible.

Both countries could see a credit rating upgrade (or at least avoid a downgrade)

Table 2. Credit Rating

| Croatia | Bulgaria | |

| Standard & Poor’s | BBB- | BBB |

| Moody’s | Ba2 | Baa2 |

| Fitch | BBB- | BBB |

Source: Bloomberg

The table shows that Bulgaria has a higher credit rating by 1 notch according to S&P and Fitch, but higher by 3 notches according to Moody’s. All else being equal, an ERM-II membership should justify a credit rating upgrade by itself. However, the effects of COVID-19 are pulling in the downward direction. Bulgaria has the second lowest Debt/GDP ratio in the EU and seems especially underappreciated by credit rating agencies.

For the next 12-24 months, we expect Croatia’s credit rating to stay stable or improve by 1 notch, while Bulgaria’s could rise by 1-2 notches to BBB+ or even A-. Such moves should be positive for the corresponding stock markets.

We expect a rise in the two stock indices

We are positive for the Croatian and Bulgarian stock markets for 3 reasons:

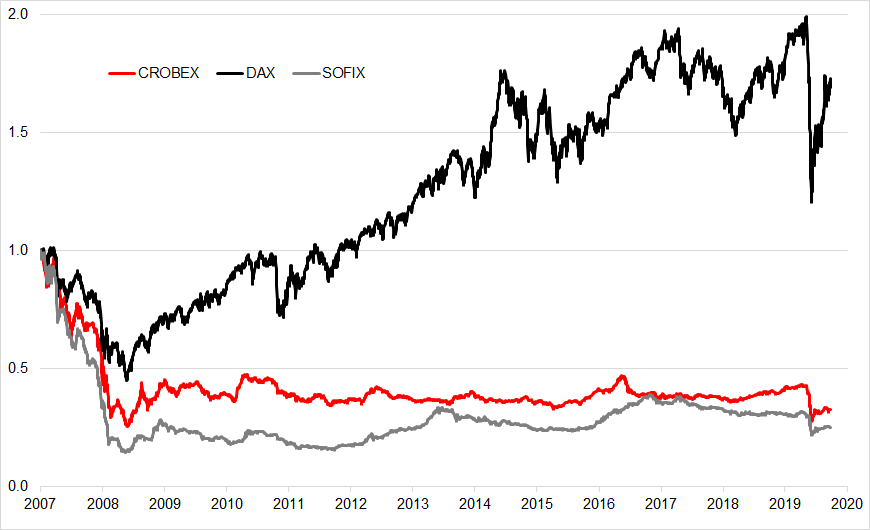

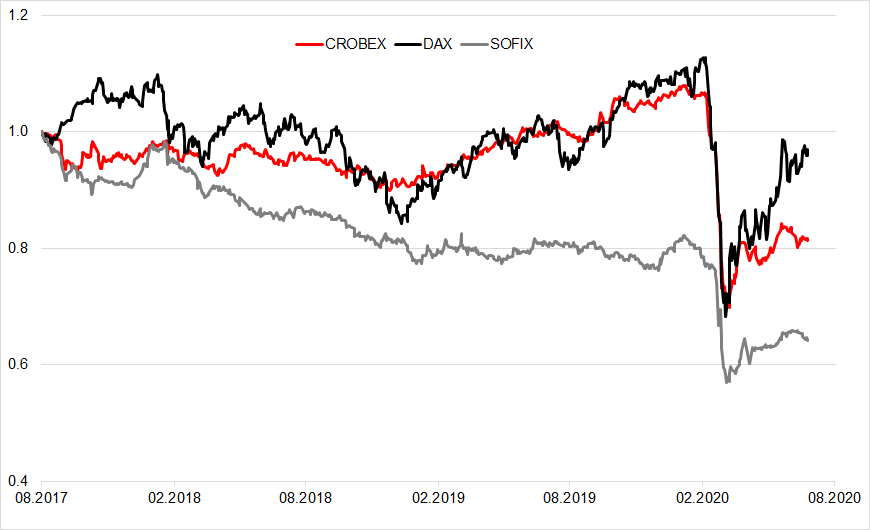

1) The 2 markets have strongly underperformed the indices in Western Europe, e.g. the DAX. In the charts below, we have presented the comparisons for the last 3 years and 13 years.

Graph 1. DAX versus SOFIX and CROBEX (In EUR, Normalized), 2007-2020

Graph 2. DAX versus SOFIX and CROBEX (In EUR, Normalized), 2017-2020

2) The valuations are relatively attractive, especially for the Bulgarian market.

Table 3. Valuations of the Indices, TTM (Trailing Twelve Months), July 2020

| Croatia | Bulgaria | |

| Index Price/Book | 0.91x | 0.47x |

| Index Price/Earnings | 15.03x | 3.59x |

Source: Bloomberg

3) The long-awaited ERM-II membership could attract more attention from international investors and could trigger a continuous rise in the 2 markets over the next 12 months. In comparison, the market in North Macedonia rose by some +50% after the country joined NATO a year ago.

Expat’s ETFs for Croatia and Bulgaria are convenient vehicles to invest in these markets

Expat manages a family of 11 ETFs which provide country-specific exposure in the CEE region for international investors. The funds track the main equity indices of Poland, the Czech Republic, Slovakia, Hungary, Slovenia, Croatia, Serbia, Macedonia, Romania, Bulgaria, and Greece. All of these funds are traded on the Frankfurt Stock Exchange and on the Bulgarian Stock Exchange. Expat Bulgaria SOFIX UCITS ETF is listed on the London Stock Exchange as well, registration on the Ljubljana Stock Exchange is expected later in 2020.

The Expat ETFs provide international investors with an easy and effective way to manage their exposure to specific countries in the region, overcoming deficiencies such as lack of liquidity, lack of access and other technical factors typical for many of the CEE markets.

Table 4. The List of All ETFs Managed by Expat Asset Management

| No | Country | Fund Name | Index | CCY Exposure |

| 1 | Poland | Expat Poland WIG20 UCITS ETF | WIG20 | PLN |

| 2 | Czech Republic | Expat Czech PX UCITS ETF | PX | CZK |

| 3 | Slovakia | Expat Slovakia SAX UCITS ETF | SAX | EUR |

| 4 | Hungary | Expat Hungary BUX UCITS ETF | BUX | HUF |

| 5 | Slovenia | Expat Slovenia SBI TOP UCITS ETF | SBI TOP | EUR |

| 6 | Croatia | Expat Croatia CROBEX UCITS ETF | CROBEX | HRK |

| 7 | Serbia | Expat Serbia BELEX15 UCITS ETF | BELEX15 | RSD |

| 8 | North Macedonia | Expat Macedonia MBI10 UCITS ETF | MBI10 | MKD |

| 9 | Romania | Expat Romania BET UCITS ETF | BET | RON |

| 10 | Bulgaria | Expat Bulgaria SOFIX UCITS ETF | SOFIX | BGN |

| 11 | Greece | Expat Greece ASE UCITS ETF | ATHEX Comp. | EUR |

Source: Expat Asset Management

Expat’s ETFs have the following characteristics:

- UCITS-compliant

- passive equity index trackers

- open-ended, providing daily liquidity

- using direct physical replication

- reinvesting dividends; not distributing any dividends

- quoted in EUR (only the Bulgarian ETF is traded in both EUR and BGN)

Expat Bulgaria SOFIX UCITS ETF invests in the shares of the companies included in the main index of the Bulgarian Stock Exchange – SOFIX – which consists of the 15 most liquid companies on BSE. Expat Croatia CROBEX UCITS ETF invests in the shares of the companies included in the CROBEX Index – the main equity index of the Zagreb Stock Exchange which consists of 19 companies.

Advantages:

- An easy and transparent way for investing in the CEE stock market. Investors buy all the companies from the index. There is no need to devote time and resources to analyze, pick and follow individual stocks.

- Diversification. Investors gain exposure to the largest and most liquid stocks on the relevant CEE stock exchange. Diversification lowers the volatility of the investment.

- Superior liquidity. The market makers of the funds maintain buy and sell quotes and ensure that the shares can be traded at any time.

- Low transaction fees. It is cheaper to invest in one instrument rather than in shares of multiple companies.

- European regulation. The Expat ETFs are fully compliant with the UCITS directive of the European Union.

****************************

RISK DISCLOSURE

This document has an informative purpose and under no circumstances should any part of it be construed as an offering or solicitation for a trade or investment in financial investments and/or professional advice connected with investment decisions. Past performance is no guarantee of future performance, and the value of investments can go down as well as up, leading to a significant loss of funds as a result. The profit is not guaranteed, and investors bear the risk that they may not receive the full amount of the invested funds. The investments in an exchange traded fund are not insured by a guarantee fund or in any other way. Shares purchased on the secondary market may not, as a general rule, be redeemed by the fund if the investors do not qualify for participation in a primary market. Investors must buy and sell the units on the secondary market with the assistance of an investment firm where additional fees may apply. Furthermore, investors may pay more than the current net asset value when buying units on secondary markets and get less than the current net asset value when selling the units. The full package of documents and information for each fund (incl. prospectus, key investors information, fund’s rules, NAV, iNAV, etc.) are published on www.expat.bg in Bulgarian and English. One may also obtain those documents at Expat’s office (Sofia, 96A G. S. Rakovski Str.) every working day from 9 a.m. to 6 p.m. The iNAV of each fund is published on www.boerse-frankfurt.de.

The information included in this document is prepared on the basis of sources which are considered reliable. All the necessary measures are taken to guarantee the precision of the content, but under no circumstances Expat Capital or Expat Asset Management should carry any responsibilities for this content and assume no compensation to the recipients or third parties as far as the precision, completeness and/or the propriety of the information.

SOFIX is developed, calculated and published by the Bulgarian Stock Exchange. The SOFIX Index is a registered trademark of the Bulgarian Stock Exchange. CROBEX is developed, calculated and published by the Zagreb Stock Exchange. The CROBEX Index is a registered trademark of the Zagreb Stock Exchange.